Content

Each payment includes both principal and interest, with the interest portion decreasing over time as the loan is paid off. To illustrate, suppose you want to save for retirement by investing in an annuity. You decide to invest a certain amount of money every month for the next 20 years.

Deferred annuities provide guaranteed income in the form of a lump sum or monthly income payments on a date in the future. You pay either a lump sum or monthly premiums to the insurer, who will then invest these funds in a manner consistent with your contractual agreement. Depending on the investment type you choose, deferred annuities offer potential for the principal to grow before receiving payments.

Finish Your Free Account Setup

This differs from an annuity due, which virtually always benefits the party receiving those payments. When interest rates go up, the value of an ordinary annuity goes down for a lender. https://kelleysbookkeeping.com/ This is because the nature of an ordinary annuity is such that it ties up the lender’s money for an extra month. Take our example above in the context of a higher-interest environment.

Present or future values of these streams of payments can be calculated by applying time value of money formulas to each of these payments. An ordinary annuity is a financial product that regularly pays out a fixed sum. However, the payments are usually made for a set period, such as for 20 years or until the annuitant’s death. A variable annuity is a type of tax-deferred annuity contract that allows you to invest your money into sub-accounts, similar to those in a 401(k). Sub-accounts can help an annuity’s growth keep up with, and sometimes outpace inflation.

Fixed annuities: The lower-risk option

Overall, an ordinary annuity is a type of financial product that provides a fixed income stream over a specified period. It is important to understand the terms and conditions of an annuity before purchasing one to ensure it meets your financial needs. For investors, Ordinary Annuity Definition an annuity typically means a product which delivers a payment at a later date. For example, many people saving for retirement purchase lifetime annuities. These are products which you buy early, and from which you receive fixed sums each month in your retirement.

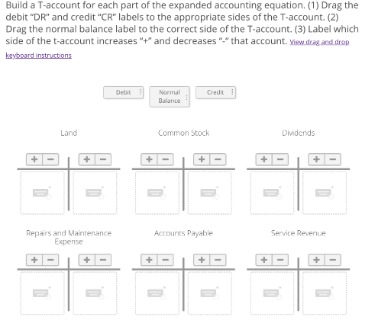

- The figure below illustrates a six-month annuity with monthly payments.

- To help you recognize the difference, the table below summarizes some key words along with common applications in which the annuity may appear.

- Present or future values of these streams of payments can be calculated by applying time value of money formulas to each of these payments.

- Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.

- Overall, an ordinary annuity is a type of financial product that provides a fixed income stream over a specified period.

The annuity provider agrees to pay a fixed rate of return on the investment and to pay a fixed amount every month for the duration of the annuity. The annuity provider agrees to pay you a fixed rate of return on your investment for the duration of the annuity and to pay you a fixed amount every month for 20 years. Thus, the present and future values of an annuity-due can be calculated. An ordinary annuity is an annuity which makes its payment at the end of each interval period. For example, an ordinary annuity with a monthly interval would make its payments at the end of the month.

Ordinary Simple Annuity

If you receive and invest $100 today, it will grow over time to be worth more than $100. This fact of financial life is a result of the time value of money, a concept which says it’s more valuable to receive $100 now rather than a year from now. It also means that receiving $100 one year from now is less valuable than receiving that same $100 today. In other words, the $100 received one year from now has a present value that is smaller than $100.

In the last (fifth) year, just enough interest will accrue to bring the balance to the $25,000 needed to complete the fifth payment. Note that the greater the number of periods and/or the size of the amount borrowed, the greater the chances of large rounding errors. We have used six decimal places in our calculations, though the actual time value of money factor, combining interest and time, can be much longer. The table below summarizes the four types of annuities and their characteristics for easy reference.